The moment you sign those purchase papers, your relationship with a vehicle transforms from a simple transaction into a complex financial commitment that extends far beyond the initial price tag. Understanding the complete lifecycle of automotive ownership reveals a intricate web of expenses that many buyers never fully grasp until they experience them firsthand. This comprehensive analysis examines every phase of vehicle ownership, from the excitement of acquisition through the sobering reality of disposal, uncovering the hidden costs that can dramatically impact your financial planning.

The automotive industry has masterfully positioned itself to emphasize upfront costs while subtly minimizing the discussion of long-term financial implications. This strategic approach often leaves consumers unprepared for the substantial ongoing expenses that define true vehicle ownership. The reality extends far beyond monthly payments and fuel costs, encompassing a sophisticated ecosystem of fees, maintenance requirements, depreciation curves, and end-of-life expenses that collectively determine the authentic cost of automotive ownership.

The Foundation Phase: Acquisition and Initial Setup

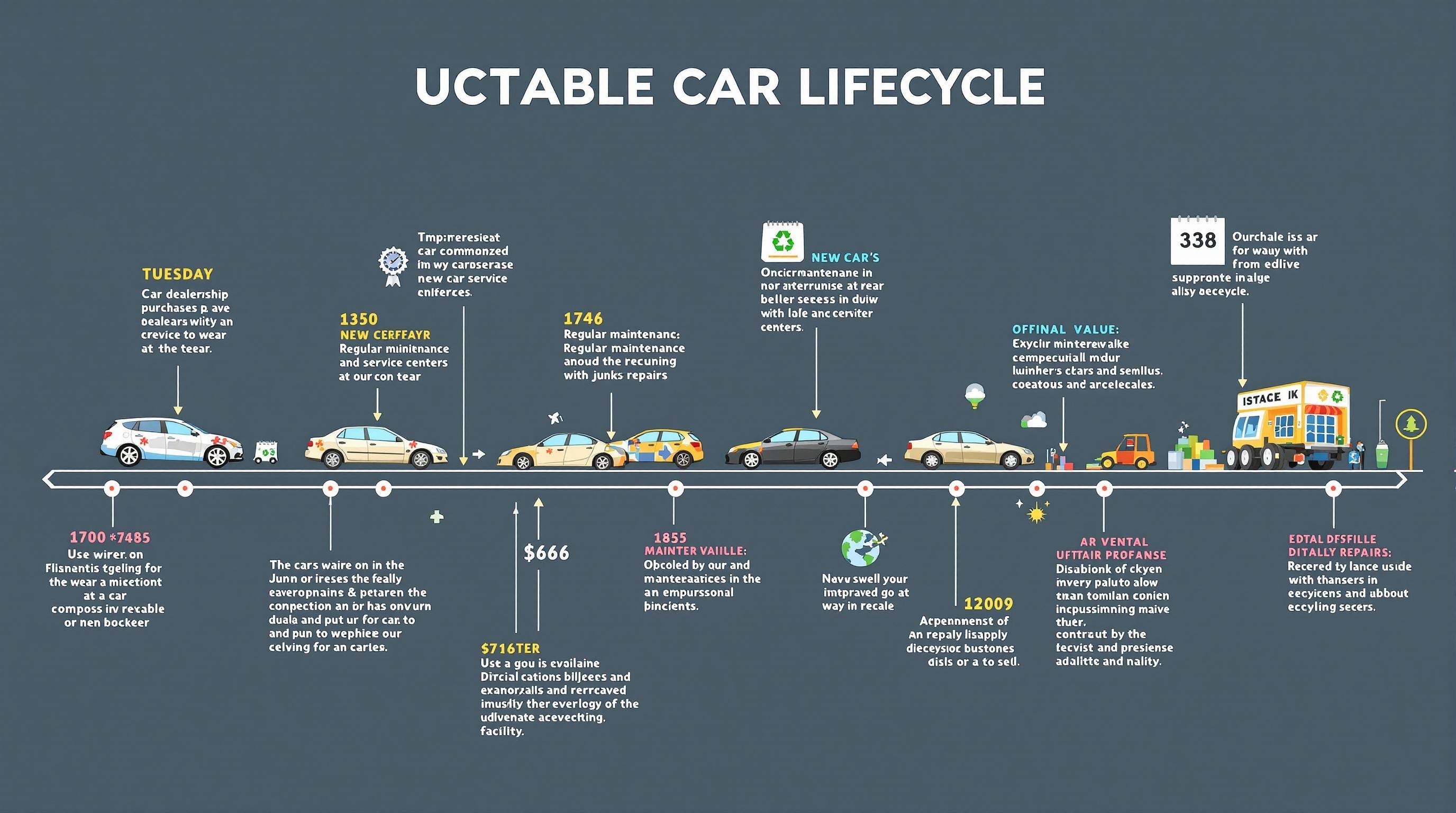

The purchase phase represents merely the beginning of your financial commitment, despite feeling like the primary expense. Beyond the vehicle’s sticker price, immediate costs cascade through various channels that buyers often overlook during the excitement of acquisition. Documentation fees, extended warranties, dealer preparation charges, and mandatory accessories create an initial cost inflation that can exceed several thousand dollars above the advertised price.

Registration and titling procedures introduce state-specific fees that vary dramatically across jurisdictions. Some regions impose minimal charges for these essential services, while others extract substantial revenue through complex fee structures that include safety inspections, emissions testing, and administrative processing. The timing of these payments often coincides with insurance policy activation, creating a concentrated financial impact during the first weeks of ownership.

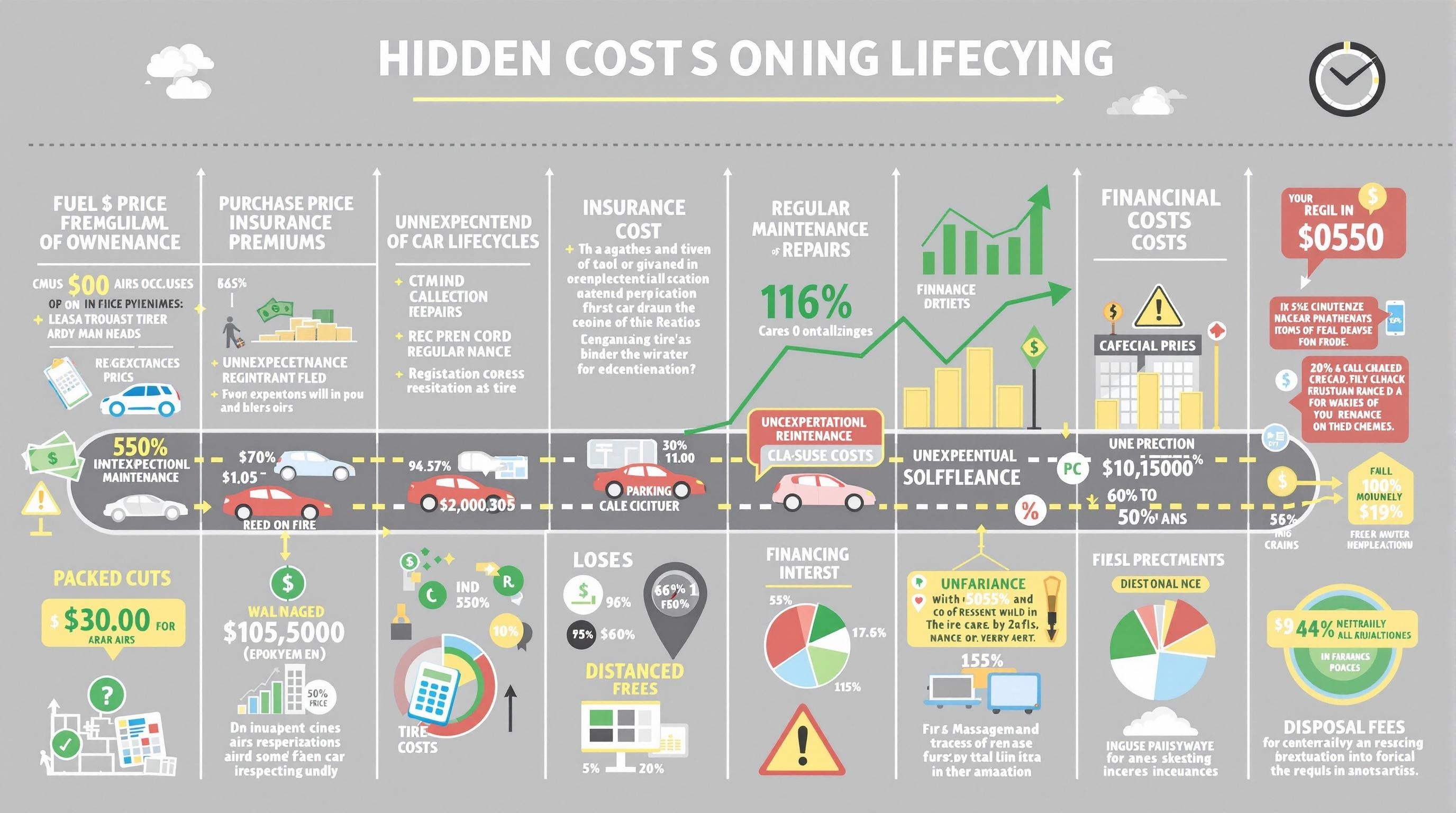

Insurance coverage decisions made during this initial phase establish long-term cost trajectories that many owners fail to fully comprehend. The difference between minimal coverage and comprehensive protection can represent thousands of dollars annually, yet the implications of these choices only become apparent when claims arise. Young drivers face particularly steep insurance costs that can exceed the vehicle’s annual depreciation, while experienced drivers with poor credit histories discover that financial history significantly influences premium calculations.

Financing arrangements introduce another layer of complexity that extends throughout the ownership period. Interest rates fluctuate based on credit scores, loan terms, and market conditions, creating substantial variation in total payments for identical vehicles. The decision between longer loan terms with lower monthly payments versus shorter terms with higher payments affects not only immediate cash flow but also total interest paid and equity building over time.

| Cost Category | Typical Range | Timing |

| Documentation Fees | $200-$800 | Purchase |

| Registration/Titling | $50-$500 | First 30 days |

| Initial Insurance | $800-$3,000 annually | Before driving |

| Extended Warranty | $1,000-$4,000 | Purchase or first year |

The Ownership Journey: Ongoing Operational Expenses

Once the initial acquisition phase concludes, the sustained financial commitment of ownership begins in earnest. Fuel consumption represents the most visible ongoing expense, yet its calculation proves more complex than simple per-gallon pricing might suggest. Driving patterns, vehicle efficiency, regional fuel price variations, and seasonal demand fluctuations create substantial cost variations that challenge budget predictability.

Insurance premiums evolve throughout the ownership period based on multiple dynamic factors beyond the owner’s direct control. Vehicle age affects replacement cost calculations, while changes in credit scores, driving records, and residential locations create ongoing premium adjustments. Insurance companies periodically reassess risk profiles, potentially resulting in significant cost increases even when no claims occur.

Maintenance requirements follow manufacturer-prescribed schedules that become increasingly expensive as vehicles age. Basic services like oil changes and tire rotations represent predictable costs, but major service intervals involving transmission fluid changes, timing belt replacements, and brake system overhauls can require thousands of dollars in single service visits. The complexity of modern vehicles means that simple maintenance tasks increasingly require specialized equipment and training, pushing costs higher while reducing the viability of do-it-yourself approaches.

Registration renewals create annual financial obligations that many jurisdictions tie to vehicle value, creating decreasing costs over time but substantial initial expenses for newer vehicles. Some states implement flat fee structures, while others calculate charges based on weight, value, or emissions profiles. Electric vehicle owners often face additional fees designed to compensate for reduced fuel tax revenue, while hybrid owners may encounter variable fee structures that change as technology adoption increases.

Unexpected repairs represent perhaps the most challenging aspect of ownership cost management. Modern vehicles contain sophisticated electronic systems that can fail without warning, requiring expensive diagnostic procedures and specialized replacement parts. Climate control systems, infotainment platforms, and safety features involve complex integrations that traditional mechanics may lack the equipment or training to service effectively.

The Depreciation Reality: Understanding Value Erosion

Depreciation represents the largest single expense for most vehicle owners, yet its impact remains largely invisible until ownership transfer occurs. New vehicles typically lose twenty to thirty percent of their value within the first year, with continued decline throughout the ownership period. This value erosion affects financial planning in ways that many owners never fully appreciate until attempting to sell or trade their vehicles.

Different vehicle categories experience distinct depreciation patterns that reflect market demand, reliability expectations, and technology evolution. Luxury vehicles often depreciate more rapidly due to higher initial margins and expensive maintenance requirements, while economy vehicles may maintain value better due to broader market appeal. Electric vehicles face unique depreciation challenges as battery technology advances rapidly, potentially making older models obsolete more quickly than traditional vehicles.

Mileage accumulation directly influences depreciation rates, but the relationship proves more complex than simple linear calculations might suggest. Vehicles with extremely low mileage may raise questions about proper maintenance and operation, while high-mileage vehicles obviously face accelerated depreciation. The optimal balance point varies by vehicle type and intended use, requiring careful consideration of driving patterns and long-term ownership plans.

Market conditions significantly impact depreciation rates through supply and demand fluctuations that owners cannot predict or control. Economic downturns typically accelerate depreciation as consumers delay vehicle purchases, while supply chain disruptions can temporarily slow depreciation by reducing new vehicle availability. Understanding these market dynamics helps owners make informed decisions about optimal selling timing.

Technology and Feature Evolution Impact

The rapid advancement of automotive technology creates unique challenges for long-term ownership financial planning. Features considered premium today often become standard equipment within a few years, accelerating the obsolescence of older vehicles. Infotainment systems face particular challenges as smartphone technology advances rapidly, making integrated systems appear dated within surprisingly short timeframes.

Safety technology evolution presents both advantages and challenges for owners of older vehicles. While newer safety features enhance protection and may reduce insurance costs, the absence of these features in older vehicles can negatively impact resale value and market appeal. Advanced driver assistance systems require expensive sensors and cameras that may be costly to replace after accidents or component failures.

Fuel efficiency improvements in newer vehicles create ongoing competitive pressure on older models through higher operating costs. As manufacturers achieve better efficiency ratings, older vehicles become less attractive to value-conscious buyers despite potentially lower purchase prices. This dynamic particularly affects owners of larger vehicles like trucks and SUVs, where efficiency improvements can be substantial.

Connectivity features increasingly integrate with smartphone platforms and cloud services that evolve continuously. Older vehicles may lose compatibility with current software versions, rendering integrated features useless and reducing overall vehicle appeal. The subscription-based nature of many modern automotive services adds ongoing costs that owners may not anticipate during the purchase process.

| Vehicle Age | Average Annual Depreciation | Technology Impact |

| Year 1-2 | 20-25% | High – rapid obsolescence |

| Year 3-5 | 10-15% | Moderate – selective updates |

| Year 6-10 | 5-10% | Low – basic functionality retained |

Regional and Environmental Considerations

Geographic location significantly influences ownership costs through climate impacts, regulatory requirements, and regional market dynamics. Northern climates impose additional expenses through winter tire requirements, increased salt-related corrosion, and battery performance degradation. Air conditioning usage in hot climates increases fuel consumption and places additional stress on cooling systems, potentially requiring more frequent maintenance.

State and local regulations create varying compliance costs that owners must navigate throughout the ownership period. Emissions testing requirements add annual or biennial expenses in many jurisdictions, while some areas impose environmental fees based on vehicle emissions profiles. California’s unique regulatory environment often requires specific equipment or modifications that increase both purchase and maintenance costs.

Urban versus rural operation patterns create distinct cost profiles that affect budgeting and vehicle selection decisions. City driving typically involves more frequent maintenance due to stop-and-go traffic patterns, while rural operation may require different tire types and higher insurance costs due to longer emergency response times. Parking costs in urban areas can represent substantial ongoing expenses that rural owners never encounter.

Regional dealer networks affect maintenance and repair costs through varying labor rates and parts availability. Areas with limited dealer presence may face higher costs due to transportation expenses and limited competition, while oversaturated markets might offer more competitive pricing but potentially inconsistent service quality.

The End-of-Life Phase: Disposal and Final Costs

The vehicle disposal phase involves costs and considerations that many owners never anticipate during the excitement of acquisition. As vehicles approach the end of their useful life, maintenance costs often escalate rapidly while value continues declining, creating challenging decisions about continued ownership versus replacement timing.

Disposal methods vary significantly in both environmental impact and financial implications. Trade-in offers convenience but typically result in lower financial returns compared to private sales. Private sales require time, effort, and assumption of various risks, while potentially providing better financial outcomes. Donation options may provide tax benefits while supporting charitable organizations, though actual financial advantages depend on individual tax situations.

Vehicles that have reached the end of their operational life require proper disposal procedures that often involve fees rather than payments to owners. Environmental regulations mandate proper handling of fluids, batteries, and other hazardous materials, creating disposal costs that owners must bear. Some regions offer recycling programs that provide minimal compensation, while others charge fees for proper environmental disposal.

The timing of vehicle disposal significantly affects financial outcomes through market condition variations and seasonal demand patterns. End-of-model-year periods often feature manufacturer incentives that can reduce trade-in values, while seasonal factors affect demand for different vehicle types. Understanding these market dynamics helps owners optimize disposal timing for better financial results.

Title transfer procedures require documentation fees and administrative costs that vary by jurisdiction. Some areas mandate inspections or emissions testing before title transfers, adding time and expense to the disposal process. Outstanding loans require coordination with lenders that may involve additional fees and processing delays.

Strategic Planning for Total Cost Optimization

Effective vehicle ownership requires strategic planning that considers the complete lifecycle rather than focusing solely on initial acquisition costs. Budget planning must account for the inevitable increase in maintenance expenses as vehicles age, while also recognizing that reliability improvements in modern vehicles extend useful life compared to older generations.

Maintenance scheduling optimization can significantly impact total ownership costs through preventive care that avoids expensive repairs. Following manufacturer recommendations provides warranty protection and maintains resale value, while strategic timing of major services can minimize unexpected failures. Understanding which maintenance tasks require dealer expertise versus general mechanic capabilities helps balance cost and quality considerations.

Insurance strategy evolution throughout the ownership period can provide substantial savings while maintaining appropriate protection levels. As vehicles depreciate, comprehensive and collision coverage may become less cost-effective relative to the protection provided. However, the decision to reduce coverage requires careful consideration of personal financial circumstances and risk tolerance.

Financing strategy impacts extend throughout the ownership period through equity building and refinancing opportunities. Market interest rate changes may create refinancing opportunities that reduce monthly payments or shorten loan terms. Understanding when vehicle equity reaches levels that eliminate gap insurance requirements can provide additional cost savings.

The decision timing for vehicle replacement requires balancing ongoing maintenance costs against new vehicle expenses while considering personal transportation needs and financial circumstances. Optimal replacement timing varies significantly based on individual driving patterns, financial situations, and reliability requirements.

Conclusion: Mastering the Complete Ownership Experience

Understanding the complete lifecycle of vehicle ownership transforms the automotive purchase decision from an emotional choice into a strategic financial decision. The true cost of ownership extends far beyond monthly payments and fuel expenses, encompassing a complex array of ongoing costs that can significantly impact long-term financial planning.

Successful vehicle ownership requires acknowledging these comprehensive costs while developing strategies to manage them effectively throughout the ownership period. By understanding depreciation patterns, maintenance requirements, and disposal considerations during the acquisition phase, owners can make informed decisions that align with their financial capabilities and transportation needs.

The automotive landscape continues evolving through technological advancement, regulatory changes, and market dynamics that affect ownership costs in ways that previous generations of owners never encountered. Staying informed about these changes and their financial implications helps current and future owners navigate the complex world of automotive ownership with greater confidence and success.

Ultimately, the vehicle that provides the best value combines initial affordability with reasonable operating costs and acceptable depreciation patterns. This balance requires careful analysis of individual circumstances rather than relying on general recommendations or marketing messages that may not align with specific ownership patterns and financial situations.

first-car

first-car