Purchasing your first automobile represents a significant milestone in personal independence, but the journey toward responsible car ownership extends far beyond selecting the perfect vehicle. The complex world of automotive insurance often overwhelms first-time buyers with unfamiliar terminology, varying coverage options, and seemingly endless policy combinations. Understanding insurance fundamentals becomes crucial not only for legal compliance but also for protecting your financial future from potentially devastating accident-related expenses.

The insurance industry operates on risk assessment principles that significantly impact first-time car owners. Insurance companies evaluate numerous factors when calculating premiums, including driver age, experience level, vehicle type, geographic location, and driving record. Young drivers typically face substantially higher insurance costs due to statistical evidence showing increased accident rates among inexperienced motorists. These elevated premiums reflect the insurance industry’s attempt to balance risk exposure with appropriate pricing structures.

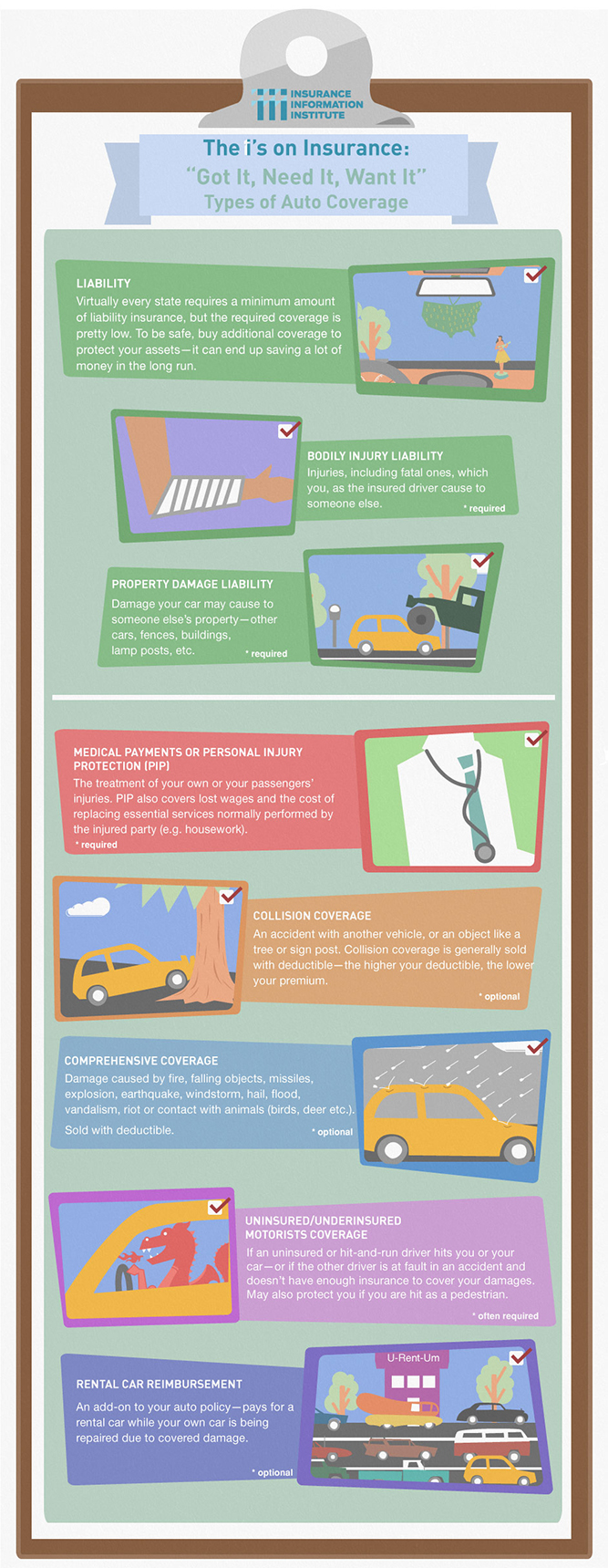

Liability Insurance forms the foundation of automotive insurance coverage and represents the minimum legal requirement in most jurisdictions. This coverage protects other parties when you cause an accident, covering their medical expenses, property damage, and related costs. Liability insurance divides into two primary components: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses, lost wages, and pain and suffering for injured parties, while property damage liability handles repair or replacement costs for damaged vehicles and property.

The minimum liability coverage requirements vary significantly between states, with some mandating relatively low coverage limits that may prove inadequate for serious accidents. For example, a state might require only twenty-five thousand dollars in bodily injury coverage per person and fifty thousand dollars per accident, amounts that could prove insufficient if you cause a severe collision involving multiple injured parties. Medical expenses for serious injuries frequently exceed these minimum amounts, potentially exposing you to significant personal financial liability.

Understanding liability coverage limits requires familiarity with the standard notation system used throughout the insurance industry. Coverage limits appear as three numbers separated by slashes, such as 100/300/100. The first number represents bodily injury coverage per person, the second indicates total bodily injury coverage per accident, and the third shows property damage coverage per accident. Higher limits provide better protection but increase premium costs, creating a balance between adequate coverage and affordability.

Collision Coverage protects your vehicle against damage resulting from collisions with other vehicles or objects, regardless of fault determination. This coverage becomes particularly valuable for newer or more expensive vehicles where repair costs could exceed the car’s remaining value. Collision coverage operates with a deductible structure, requiring you to pay a predetermined amount before insurance benefits activate. Common deductible amounts range from two hundred fifty to one thousand dollars, with higher deductibles resulting in lower premium costs.

The decision regarding collision coverage often depends on your vehicle’s value and your financial ability to absorb repair costs. If your car’s value exceeds five thousand dollars or you lack sufficient savings to cover major repairs, collision coverage provides essential financial protection. However, for older vehicles with limited value, collision coverage premiums might exceed potential claim benefits, making this coverage economically impractical.

Collision coverage excludes certain types of damage, including mechanical failures, normal wear and tear, and damage from non-collision incidents like theft or vandalism. Understanding these exclusions helps prevent disappointment when filing claims and emphasizes the importance of comprehensive coverage for complete vehicle protection.

Comprehensive Coverage addresses non-collision damages including theft, vandalism, weather damage, fire, and animal collisions. This coverage type proves particularly valuable in areas prone to severe weather, high crime rates, or significant wildlife populations. Like collision coverage, comprehensive insurance operates with deductible structures, allowing you to balance premium costs against out-of-pocket expenses.

Comprehensive coverage decisions should consider your geographic location and vehicle storage arrangements. Urban areas with higher theft rates justify comprehensive coverage even for older vehicles, while rural areas with severe weather patterns make this coverage essential regardless of vehicle age. Vehicles stored in secure garages face lower comprehensive risks compared to those parked on streets or in open lots.

The comprehensive coverage also extends to rental car reimbursement and roadside assistance in many policies. These additional benefits provide convenience and peace of mind during vehicle repairs, though they increase premium costs. Evaluating these optional coverages requires considering your access to alternative transportation and emergency assistance resources.

Personal Injury Protection and Medical Payments Coverage address medical expenses for you and your passengers regardless of fault determination. These coverages prove particularly valuable in no-fault insurance states where traditional liability insurance may not cover your medical expenses following accidents. Personal Injury Protection typically provides broader coverage including lost wages and essential services, while Medical Payments Coverage focuses specifically on medical expenses.

The value of medical coverage depends on your existing health insurance and state insurance laws. Individuals with comprehensive health insurance may find medical payments coverage redundant, while those with limited health coverage benefit significantly from automotive medical protection. No-fault insurance states often mandate Personal Injury Protection, eliminating choice while providing standardized medical coverage.

Understanding coordination of benefits becomes crucial when multiple insurance policies could cover the same medical expenses. Automotive insurance typically serves as primary coverage for accident-related injuries, with health insurance providing secondary coverage. This arrangement prevents double payment while ensuring comprehensive medical coverage for accident victims.

Uninsured and Underinsured Motorist Coverage protects against damages caused by drivers lacking adequate insurance coverage. Despite legal requirements, significant percentages of drivers operate without insurance or carry insufficient coverage limits. This reality creates substantial financial risks for responsible drivers who could face uncollectable claims against uninsured motorists.

Uninsured motorist coverage operates similarly to liability insurance, protecting you and your passengers when other drivers cause accidents but lack insurance coverage. Underinsured motorist coverage activates when at-fault drivers carry insurance but insufficient limits to cover your damages fully. These coverages prove particularly valuable in states with low minimum insurance requirements where many drivers carry inadequate protection.

The decision regarding uninsured motorist coverage should consider your state’s uninsured driver rates and typical insurance requirements. States with high uninsured driver percentages justify higher uninsured motorist coverage limits, while states with robust insurance enforcement may require lower coverage levels. This coverage type often represents excellent value due to relatively low premium costs compared to potential benefits.

| Coverage Type | What It Protects | Typical Cost Range | Recommended For |

| Liability | Other people’s injuries/property | $400-800/year | All drivers (mandatory) |

| Collision | Your car in accidents | $200-600/year | Newer/financed vehicles |

| Comprehensive | Theft, weather, vandalism | $150-400/year | All vehicles in risk areas |

| Medical Payments | Your medical expenses | $50-150/year | Drivers with limited health insurance |

| Uninsured Motorist | Protection from uninsured drivers | $100-300/year | All drivers (highly recommended) |

Premium Calculation Factors significantly impact insurance costs, particularly for first-time buyers. Age represents the most significant factor, with drivers under twenty-five facing substantially higher premiums due to increased accident statistics. Gender also influences rates, with young male drivers typically paying higher premiums than their female counterparts due to higher accident and violation rates.

Geographic location affects premiums through multiple factors including accident rates, theft statistics, weather patterns, and legal environments. Urban areas generally command higher premiums due to increased accident frequencies, while rural areas may face higher rates due to longer emergency response times and wildlife collision risks. Some states mandate specific coverage types or limit insurance company rating factors, creating regional premium variations.

Vehicle selection dramatically impacts insurance costs through safety ratings, theft rates, repair costs, and performance characteristics. Sports cars and luxury vehicles typically carry higher premiums due to increased theft risks and expensive repair costs, while family-oriented vehicles with strong safety ratings often qualify for lower rates. The Insurance Institute for Highway Safety and National Highway Traffic Safety Administration provide safety ratings that directly influence insurance costs.

Credit scores increasingly influence insurance premiums in states permitting this practice. Insurance companies argue that credit scores correlate with claim frequencies, though consumer advocates question this relationship. Maintaining good credit scores can result in significant insurance savings, while poor credit may substantially increase premiums.

Policy Shopping Strategies require systematic approaches to ensure adequate coverage at competitive prices. Obtaining quotes from multiple insurance companies reveals significant premium variations for identical coverage, sometimes differing by hundreds or thousands of dollars annually. Direct writers, independent agents, and online platforms each offer advantages and disadvantages in the shopping process.

Direct insurance companies eliminate agent commissions, potentially offering lower premiums while requiring customers to navigate coverage decisions independently. Independent agents provide personalized service and multi-company comparisons but may focus on higher-commission products. Online platforms offer convenient comparisons but may lack personalized guidance for complex coverage decisions.

Understanding quote components becomes essential for accurate comparisons. Insurance quotes should include identical coverage limits, deductibles, and optional coverages to ensure meaningful comparisons. Some companies offer lower base premiums but charge higher rates for common optional coverages, making total cost comparisons more accurate than base premium comparisons.

Timing insurance purchases strategically can result in significant savings. Many companies offer discounts for purchasing policies before current coverage expires, while others provide new customer incentives. Annual policy renewals present opportunities to review coverage needs and shop alternative providers, though frequent switching may eliminate loyalty discounts.

Discount Opportunities provide substantial premium reductions for qualifying drivers. Multi-policy discounts reward customers combining automobile insurance with homeowners or renters insurance, often providing ten to twenty-five percent savings on both policies. These discounts prove particularly valuable for first-time car buyers establishing insurance relationships.

Good student discounts recognize academic achievement with premium reductions, typically requiring grade point averages of 3.0 or higher. These discounts acknowledge correlations between academic responsibility and driving behavior, providing meaningful savings for qualifying student drivers. Maintaining eligibility requires periodic grade verification and continuous enrollment.

Defensive driving course discounts reward voluntary safety education with premium reductions. Many states approve specific courses that qualify for insurance discounts, providing both safety education and financial benefits. These courses prove particularly valuable for drivers with violations seeking premium reductions or safety-conscious individuals pursuing additional discounts.

Vehicle safety feature discounts recognize cars equipped with advanced safety technologies. Anti-lock brakes, airbags, anti-theft systems, and electronic stability control often qualify for premium reductions. Newer vehicles with advanced driver assistance systems may qualify for additional discounts as insurance companies recognize their accident-prevention potential.

| Age Group | Average Annual Premium | Common Discounts Available | Money-Saving Tips |

| 16-19 years | $3,000-5,000 | Good student, defensive driving, family policy | Stay on parents’ policy, choose safe vehicle |

| 20-24 years | $2,000-3,500 | Multi-policy, good driver, safety features | Compare quotes annually, maintain clean record |

| 25-30 years | $1,200-2,200 | Multi-policy, homeowner, loyalty | Bundle policies, increase deductibles |

Accident Response Procedures require immediate attention to ensure safety and preserve insurance claim rights. The first priority involves ensuring personal safety by moving vehicles from traffic lanes when possible and calling emergency services for injuries or significant damage. Documenting accident scenes through photographs, witness statements, and detailed notes provides crucial evidence for insurance claims and potential legal proceedings.

Information exchange protocols require collecting specific details from all involved parties including names, contact information, insurance companies, policy numbers, and driver’s license numbers. Avoiding admission of fault protects your interests during claim investigations, as fault determination requires thorough investigation of accident circumstances. Seemingly minor statements can complicate claim resolutions and potentially affect fault determinations.

Prompt notification of insurance companies activates claim processes and ensures compliance with policy requirements. Most policies require notification within specific timeframes, typically twenty-four to seventy-two hours after accidents. Delayed notification can result in claim denials or complications, emphasizing the importance of immediate contact with insurance representatives.

Police report procedures vary by jurisdiction and accident severity. Many areas require police reports for accidents involving injuries, significant damage, or disputed circumstances. Obtaining police report numbers and understanding when reports become available facilitates insurance claim processing. Some minor accidents may not warrant police involvement, but documentation remains crucial for insurance purposes.

Insurance Claim Processes involve multiple stages requiring patience and attention to detail. Initial claim reporting triggers investigations that may include adjuster assignments, damage assessments, and fault determinations. Understanding these processes helps manage expectations and ensures appropriate cooperation with insurance representatives.

Damage assessment procedures typically involve professional adjusters evaluating vehicle damage and repair costs. Preferred provider networks may influence repair shop selections, though policyholders generally retain rights to choose repair facilities. Understanding repair estimate processes and supplement procedures ensures adequate damage coverage and quality repairs.

Rental car coverage provisions activate during claim processing when policies include this coverage. Understanding rental allowances, coverage periods, and approved rental companies prevents unexpected expenses during vehicle repairs. Some policies limit daily rental amounts or total coverage periods, requiring careful monitoring of rental arrangements.

Settlement negotiations may become necessary when initial offers appear inadequate or when fault determinations seem inappropriate. Understanding policy language, state insurance laws, and claim appeal processes protects your interests during settlement discussions. Complex claims may benefit from legal consultation, particularly when significant damages or injuries occur.

Special Considerations for New Drivers address unique challenges facing first-time car owners. Graduated driver licensing programs in many states affect insurance requirements and may provide premium discounts for completing approved driver education programs. Understanding these requirements ensures compliance while maximizing available discounts.

Parent policy additions often provide significant savings compared to independent policies for young drivers. Adding teen drivers to existing family policies typically costs less than separate coverage, though this arrangement requires careful consideration of liability exposure. Understanding how violations and claims affect family policies helps make informed decisions about coverage arrangements.

College student considerations include coverage during school attendance, particularly when attending institutions far from home. Many policies provide coverage territory that includes college locations, but understanding specific policy language prevents coverage gaps. Storage coverage for vehicles not driven during college attendance can reduce premiums while maintaining essential protection.

Financial Planning Integration connects insurance decisions with broader financial goals and risk management strategies. Emergency fund planning should account for insurance deductibles and potential premium increases following claims. Understanding how insurance claims affect premiums helps balance claim filing decisions with long-term cost considerations.

Insurance costs should integrate with overall transportation budgeting including fuel, maintenance, and vehicle payments. First-time car buyers often underestimate total ownership costs, leading to financial strain when insurance premiums exceed expectations. Comprehensive budgeting ensures sustainable car ownership without compromising other financial priorities.

Long-term insurance relationships may provide benefits through loyalty discounts and claim forgiveness programs. Establishing positive relationships with insurance companies and agents facilitates smoother claim processes and may result in more favorable treatment during difficult situations. However, loyalty should not prevent periodic shopping to ensure competitive pricing and adequate coverage.

Technology and Insurance Evolution increasingly influences coverage options and pricing structures. Usage-based insurance programs monitor driving behavior through smartphone apps or vehicle devices, potentially offering significant discounts for safe driving patterns. Understanding these programs helps determine whether privacy concerns outweigh potential savings.

Telematics devices provide detailed driving data including speed, acceleration, braking, and cornering behavior. Insurance companies use this data to assess risk more accurately and potentially offer personalized pricing. First-time drivers with limited driving records may benefit significantly from demonstrating safe driving through telematics programs.

Advanced driver assistance systems in newer vehicles may qualify for additional discounts as insurance companies recognize their safety benefits. Understanding how vehicle technology affects insurance costs influences vehicle selection decisions and coverage options. Future developments in autonomous vehicle technology will continue reshaping insurance requirements and pricing structures.

The complexity of automotive insurance requires careful study and consideration, particularly for first-time buyers navigating unfamiliar territory. Understanding coverage types, premium factors, discount opportunities, and claim processes empowers informed decision-making that protects both financial interests and legal compliance. Successful insurance management requires ongoing attention to changing needs, market conditions, and available options, ensuring optimal protection throughout your driving experience.

Regular policy reviews ensure coverage remains appropriate as circumstances change, including vehicle changes, location moves, and family status modifications. Working with knowledgeable insurance professionals provides valuable guidance while maintaining personal responsibility for understanding policy terms and conditions. The investment in comprehensive insurance education pays dividends through better coverage decisions, lower costs, and smoother claim experiences when accidents inevitably occur.

first-car

first-car